The Covid Canvas, Pt. 4

How have Americans’ attitudes about returning to normal activities changed in recent weeks? Dr. Don Vaughn surveyed over a thousand Americans about reopening the economy and returning to restaurants, airplanes, and sporting events. Consumer sentiment has improved in recent weeks, but it still has a ways to go in most sectors.

Highlights

- We used the Realtime Research™ survey unit to ask Americans when they would consider returning to a variety of normal activities.

- Respondents are more likely to return soon to low-density activities such as going to the dentist and getting a haircut.

- There has been an improvement in consumer sentiment towards all activities surveyed, except sporting events.

- Respondents remain uncomfortable with reopening plans, but less so than previous months.

Two weeks ago, we again asked Americans when they would consider returning to various activities. Specifically, we asked them to predict at what point in the future they would consider going back to normal activities like dining at restaurants, going to the gym, and going to large sporting events. We originally found that a majority of Americans were hesitant to return to these activities relative to the period 3 weeks prior. Many felt negatively towards their state’s reopening plan and felt they were moving too fast. Additionally, many were less willing to eat at a restaurant or go to the gym then than they were before. We showed that Americans’ hesitancy to re-engage in certain activities was partially explained by density—both the population density of the respondents’ home state and the typical crowd density associated with the activities in question.

The COVID Canvas, Part 4

From July 17th to August 4th, we used a Realtime Research™ survey to re-canvas Americans about their intentions to resume participation in various activities. Invisibly Realtime Research™ surveys differ from traditional online surveys in that the questions are shown to the user on webpages in place of an ad (Figure 1). Unlike Google Surveys, which block access to content until the questions are answered,Realtime Research™ surveys are optional, thus ensuring that participants are responding voluntarily.

We asked Americans when they would consider visiting the dentist, getting a haircut, going to the gym, dining at restaurants, traveling on airplanes, vacationing with crowds, attending sporting events, going on cruises, and a variety of other questions. Respondents answered each question by selecting “Now,” “1-2 Months,” “3-6 Months,” or “6+ Months.” Over the two and a half week survey period, we received 12,736 responses from 1,570 individuals representing all 50 states.

Figure 1. An example of the 300×250 Realtime Research™

survey unit. Questions are shown to the user on webpages in place of an

ad.

,

Results

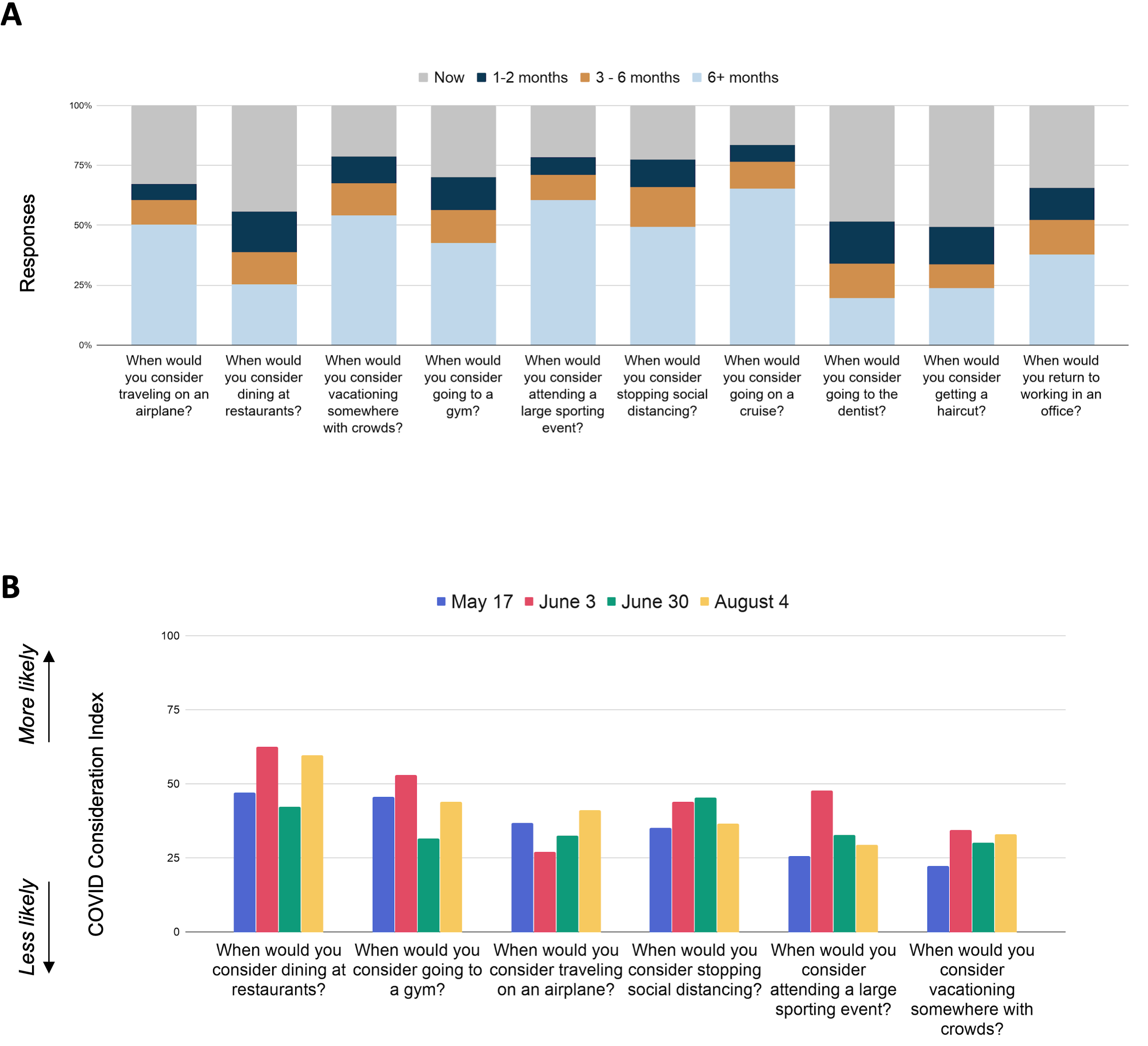

Americans are ready to return to some pre-pandemic activities (Figure 2A). Many are willing to dine at restaurants, go to the dentist, and get a haircut immediately. On the other hand, smaller percentages of Americans are willing to consider attending a large sporting event, vacation somewhere with crowds, or go on a cruise in the near future.

We compared these results to our previous COVID Canvas results. To simplify this comparison, we combined the 4 possible responses into a single number—the Covid Consideration Index (CCI)—by assigning a value to each response: 0 for “6+ Months,” 33 for “3-6 Months,” 66 for “1-2 Months,” and 100 for “Now.” This index measures how much, from 0 to 100, those surveyed were willing to engage in a given activity. In the time between the first and second surveys (May 17th to June 3rd), consumer sentiment improved across many sectors including restaurants, vacationing, and sporting events. In the time between the second and third surveys (June 3rd to June 30th), there was a broad regression in consumer sentiment in nearly all areas surveyed. However, in the time between the third and fourth survey, consumer sentiment improved again across most categories including going to the gym, dining at restaurants, and flying on airplanes (Figure 2B).

Figure 2. Americans are ready to return to some activities. A. Results from our Realtime Research™ surveys suggest that Americans are more ready to return to activities that involve fewer people in close proximity than to those with denser crowds. B. Comparing these results with those from seven weeks prior, consumer sentiment improved in most areas.

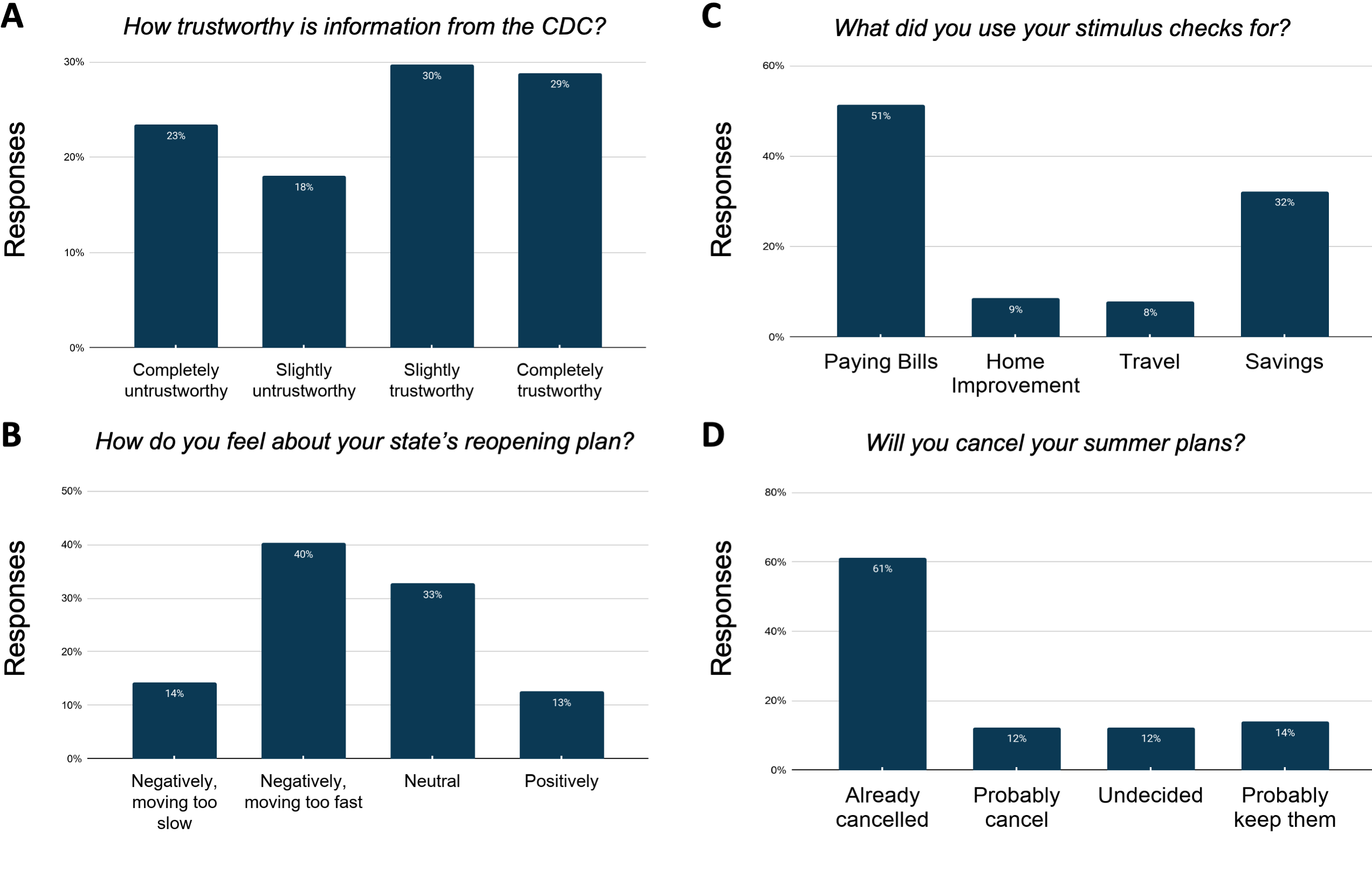

We also asked Americans a set of more general pandemic-related questions regarding their trust in the CDC, their state’s reopening plan, their stimulus check, and their summer plans. Majority of Americans trust the CDC and many are nervous about the speed of reopening (Figure 3A, 3B). However, there is a significant group of people who are neutral towards their states reopening (Figure 3B). The majority used their stimulus check to pay bills (Figure 3C), and already have cancelled their summer plans (Figure 3D).

Figure 3. General questions about living in the pandemic. Americans generally trust the CDC, are nervous or neutral about the speed of reopening, used their stimulus check to pay bills, and already have cancelled their summer plans.

Discussion

We show here that Americans continue to be more hesitant about re-engaging in activities that involve denser crowds. Although we found an increase in readiness to re-engage in many areas, a majority of Americans are still unlikely to consider vacationing with crowds or go to a large sporting event in the near future. It is possible that full recovery of these sectors may require significant investment in infrastructure to mitigate transmission risks and allay the public’s concerns. As of today – of the professional sports leagues which have continued play – many have banned fans from attending games.

Our more general panel of questions revealed that the majority of Americans trust the CDC as an institution, and while people are still nervous that their state is reopening too fast, there has been a rise in the number of people who feel neutral towards their state’s reopening plan. Most respondents already had cancelled their summer plans, and they used their stimulus check to pay bills rather than fund a vacation.

We intend these results to improve the predictive modeling of businesses across America so they can plan supply lines and hirings accordingly. We selected these questions to capture a wide snapshot of Americans’ plans regarding several types of economic reopening. However, the Realtime Research™ Survey unit may be used to gather more nuanced information in particular business sectors. These data will be updated again in the coming weeks.

Dr. Don Vaughn, Ph.D.

Dr. Don Vaughn is a neuroscientist, futurist, and communicator. As Head of Product at Invisibly, he is envisioning a better future by enabling people to take control of their personal data. He leverages his understanding of the brain to predict how people will use—and be used by—technology. Since graduating from Stanford, over 1 million people have viewed his TEDx talk. He has been featured on ABC, ESPN, Bloomberg and more.