Should Biden Forgive Student Loans?

Student loan forgiveness has become a hot topic issue for the Biden administration. We used it’s Realtime Research tool to poll 1141 Americans and found people fall into one of three camps: offer 10k of loan forgiveness, offer up to 50k of loan forgiveness or don’t offer student loan debt forgiveness at all.

Highlights

- We surveyed over 1100 people on their opinions about student loan forgiveness and how the Biden administration should tackle it.

- The results show that most people, whether they have student loans or not, favor some amount of loan forgiveness.

- Nearly two-thirds of people currently with student loans are waiting for loan forgiveness to pass to pay down their debt.

Results

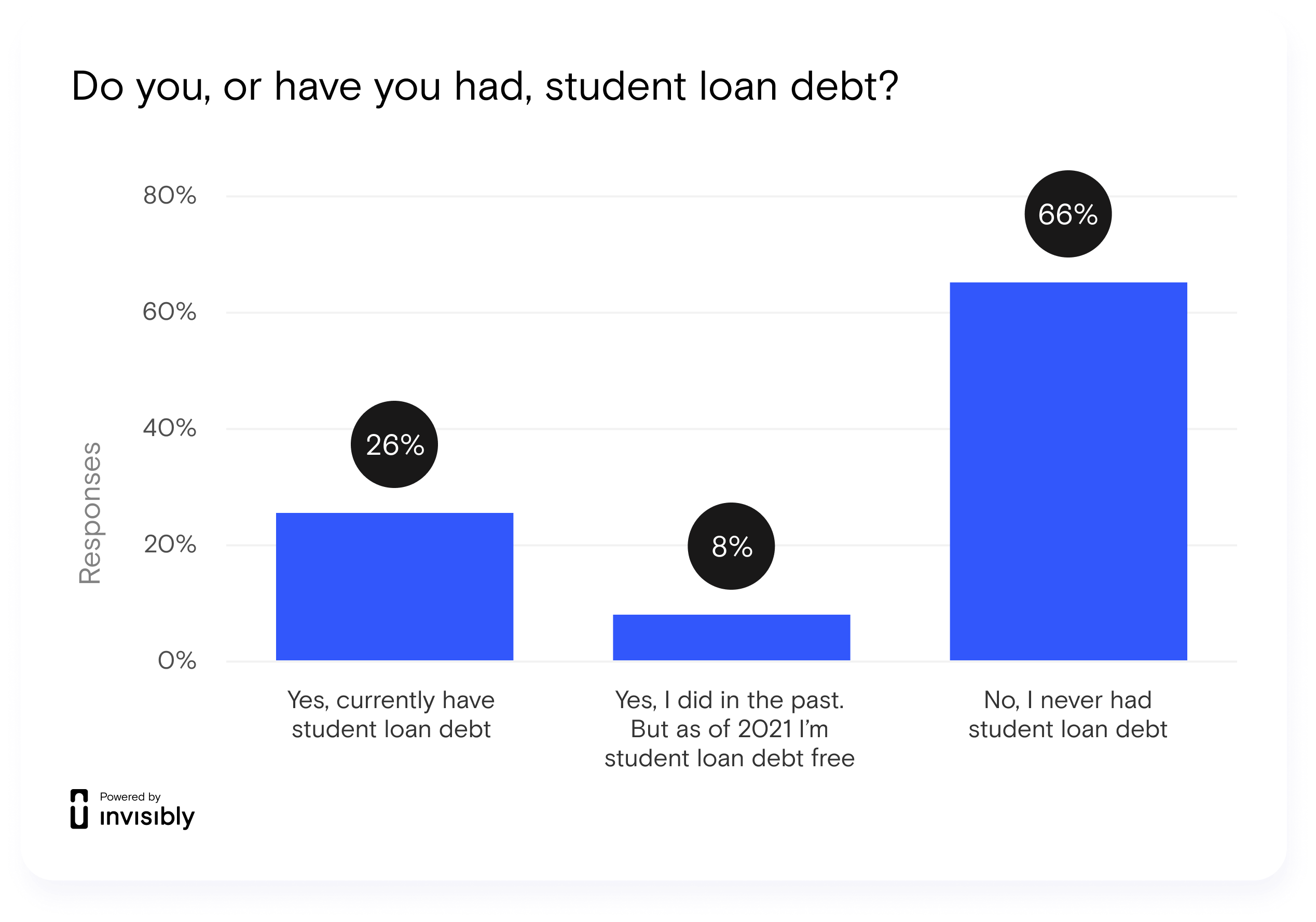

A surprising number of those surveyed say they have never had student loan debt. 66% reported never having student loan debt compared to 34% who either currently do or have had student loans in the past.

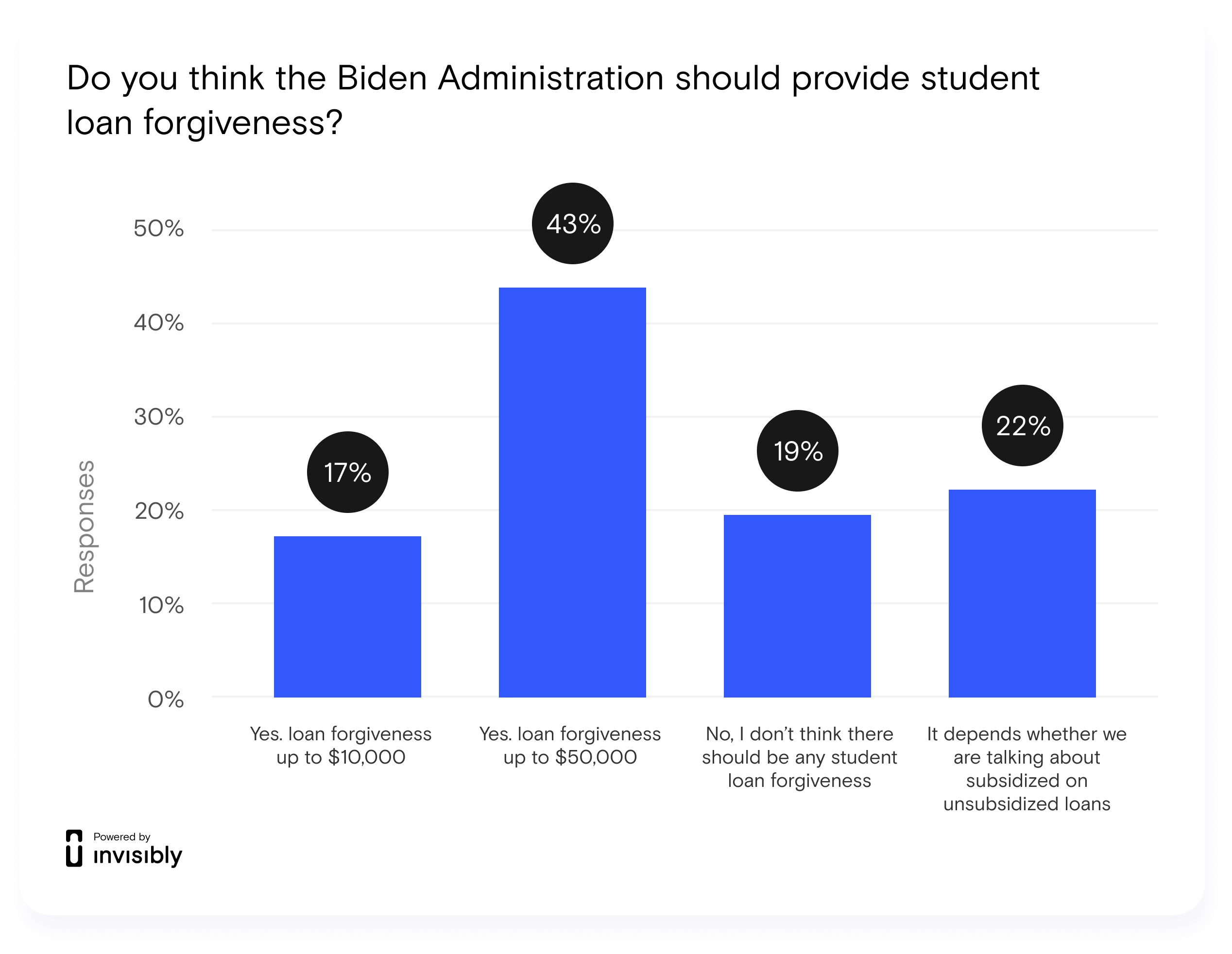

When asked whether the Biden administration should provide student loan forgiveness, 60% were outright in favor, with an additional 22% saying it depended on whether the loans were subsidized or not. Only 19% said they are not in favor of any amount of loan forgiveness.

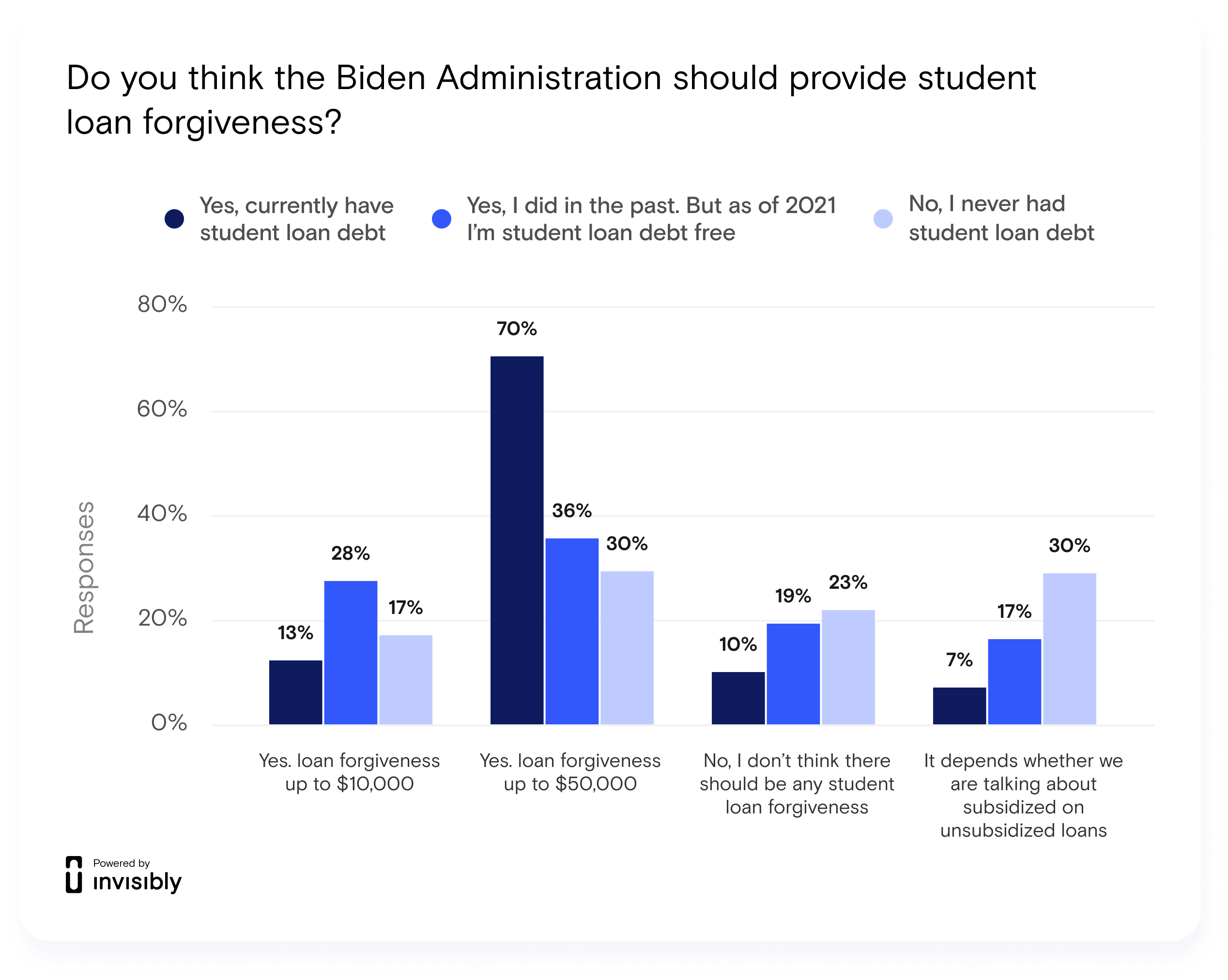

When we analyzed the data and looked at responses based on whether people currently have student loans or not, 83% of those currently with student loans favor forgiveness: 70% of favor up to $50k in loan forgiveness with an additional 13% favoring up to $10k in forgiveness. Only 10% of people currently with student loans don’t support any form of loan forgiveness.

64% of people who had prior loans favor loan forgiveness, but are split in the amount with 28% falling in the up to $10k category and only 36% being that up to $50k should be forgiven. 19% with prior loans don’t believe there should be any form of loan forgiveness.

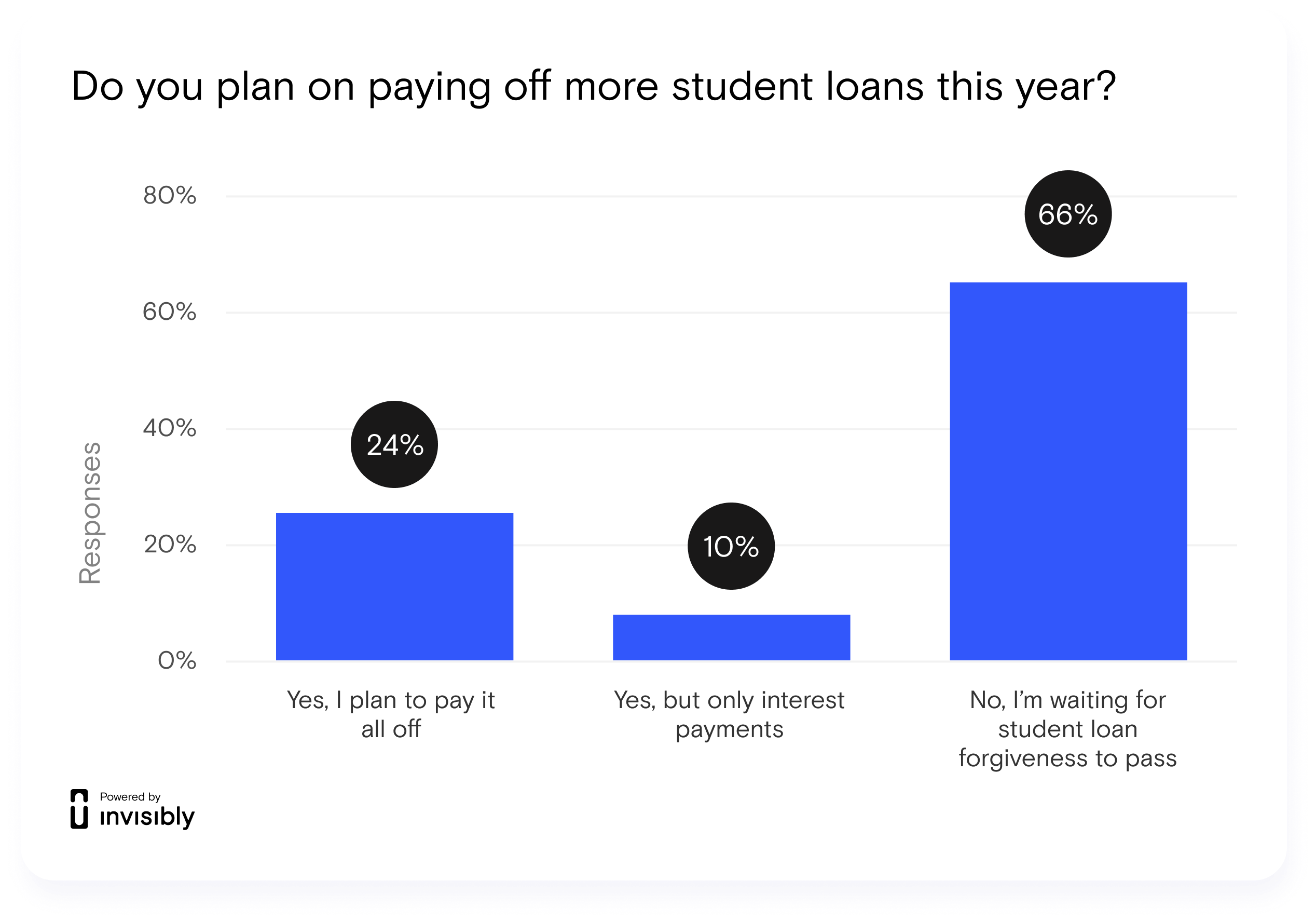

When asked about how people will approach paying their loans this year, 66% of those with current loans plan to wait for loan forgiveness to pass, compared to 24% that plan to pay off their loans regardless. Only 10% said they would make interest-only payments.

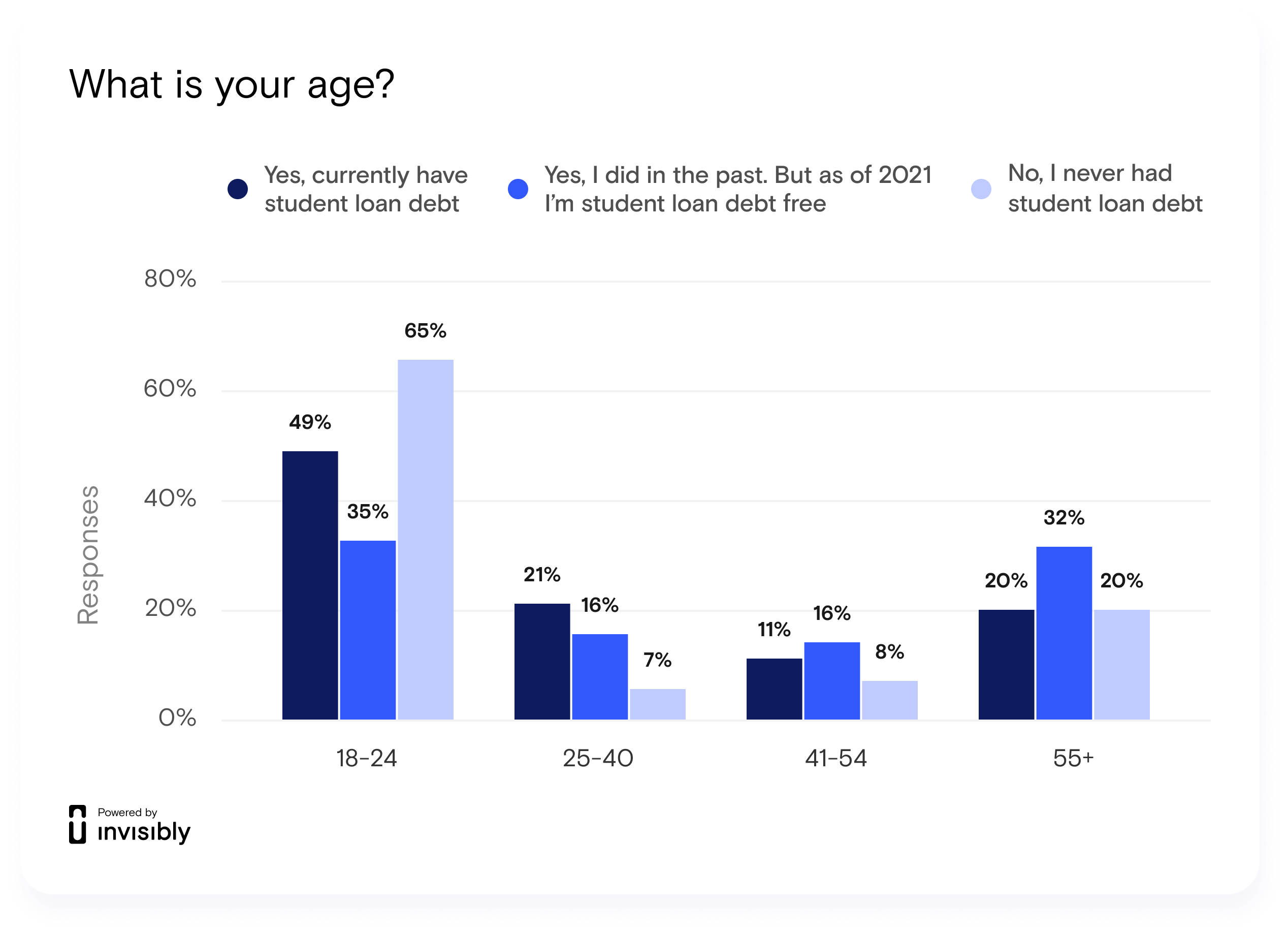

The majority of respondents with current or past loans are in the 18-24 year old age range, and surprisingly it is also the group with the largest number of people (65%) who said they have never had student loans. Millennials and Gen X apparently bore the brunt of student loans, with only 7% and 8% respectively saying they have never had student loan debt.

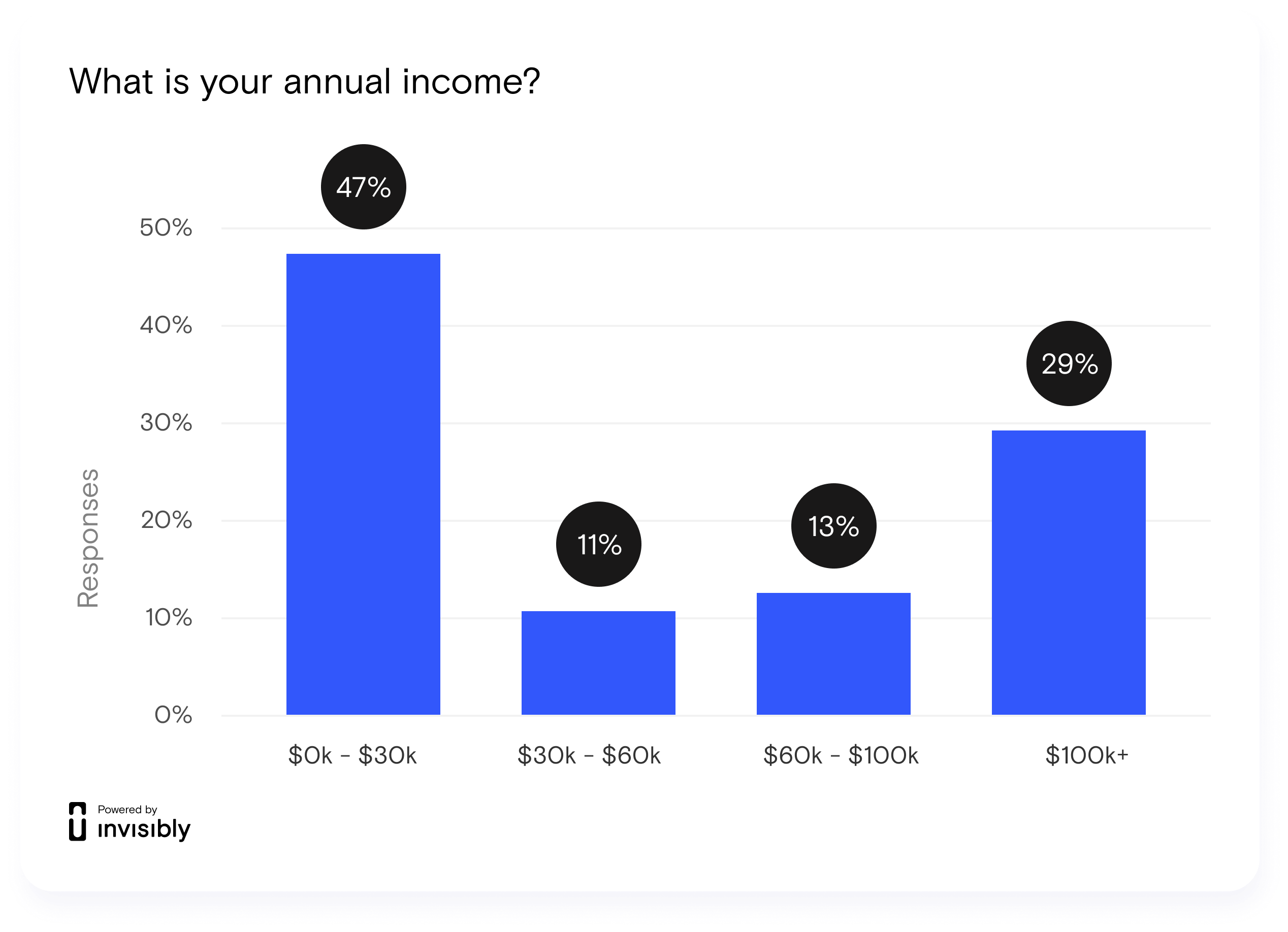

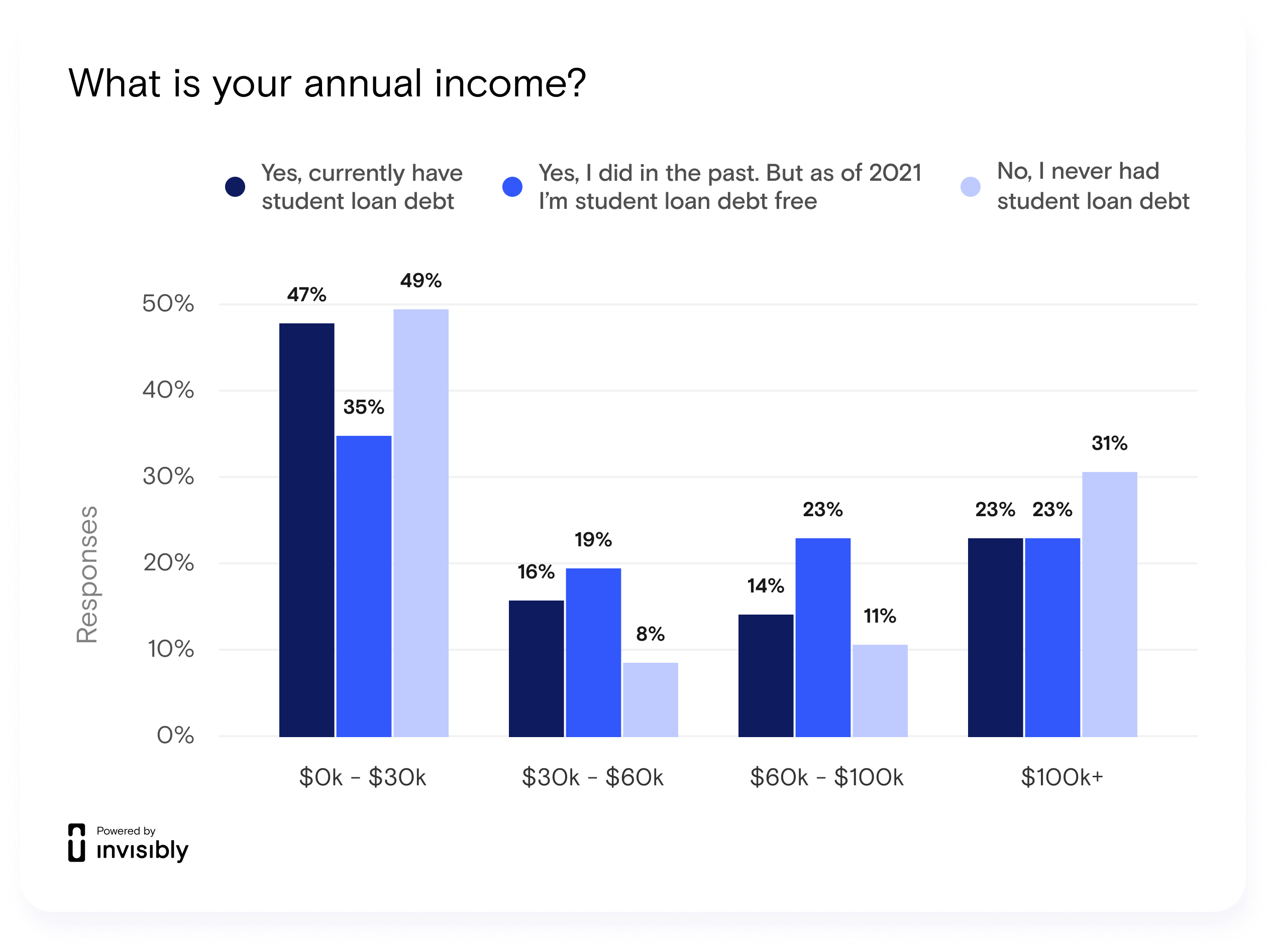

47% of respondents have an income between $0-$30k a year, with only 29% reporting an income of over $100k a year. 47% of those currently saddled with student loan debt are in the $0-$30k a year income bracket, compared to 23% that make over $100k a year.

The Process

From February 23rd – 26th, 2021 Invisibly questioned 1141 Americans about their opinions on student loan forgiveness. Invisibly used their Realtime Research polling tool to learn whether people currently have student loans, if the Biden administration should forgive student loan debt and what peoples plans are regarding paying off their own loans. We also asked questions about age and income to see if this played a factor in people’s responses.

We Asked

- Do you, or have you had, student loan debt?

- Do you think the Biden Administration should provide student loan forgiveness?

- Do you plan on paying off more student loans this year?

- What is your age?

- What is your annual income?

Discussion

We learned that student loan debt doesn’t only apply to high income earners or recent grads, as many people think: it affects people of all ages and income levels. Those in the lowest income bracket have shown to have more current and previous student loan debt than their higher income-earning counterparts. Surprisingly, 20% of people over age 55 reported they still have student loan debt, further highlighting why this is an issue for the Biden administration. It’s clear from this report that many people, regardless of age, are not financially equipped to pay off their student loans in a timely fashion.

Invisibly Realtime Research surveys differ from traditional online surveys in that the questions are shown to the user on web pages in place of an ad (Figure 1). Unlike Google Surveys, which block access to content until the questions are answered, Realtime Research surveys are optional, thus ensuring that participants are responding voluntarily.

Invisibly

Use your data to access premium content you love.