Stock Market Frenzy Sentiment

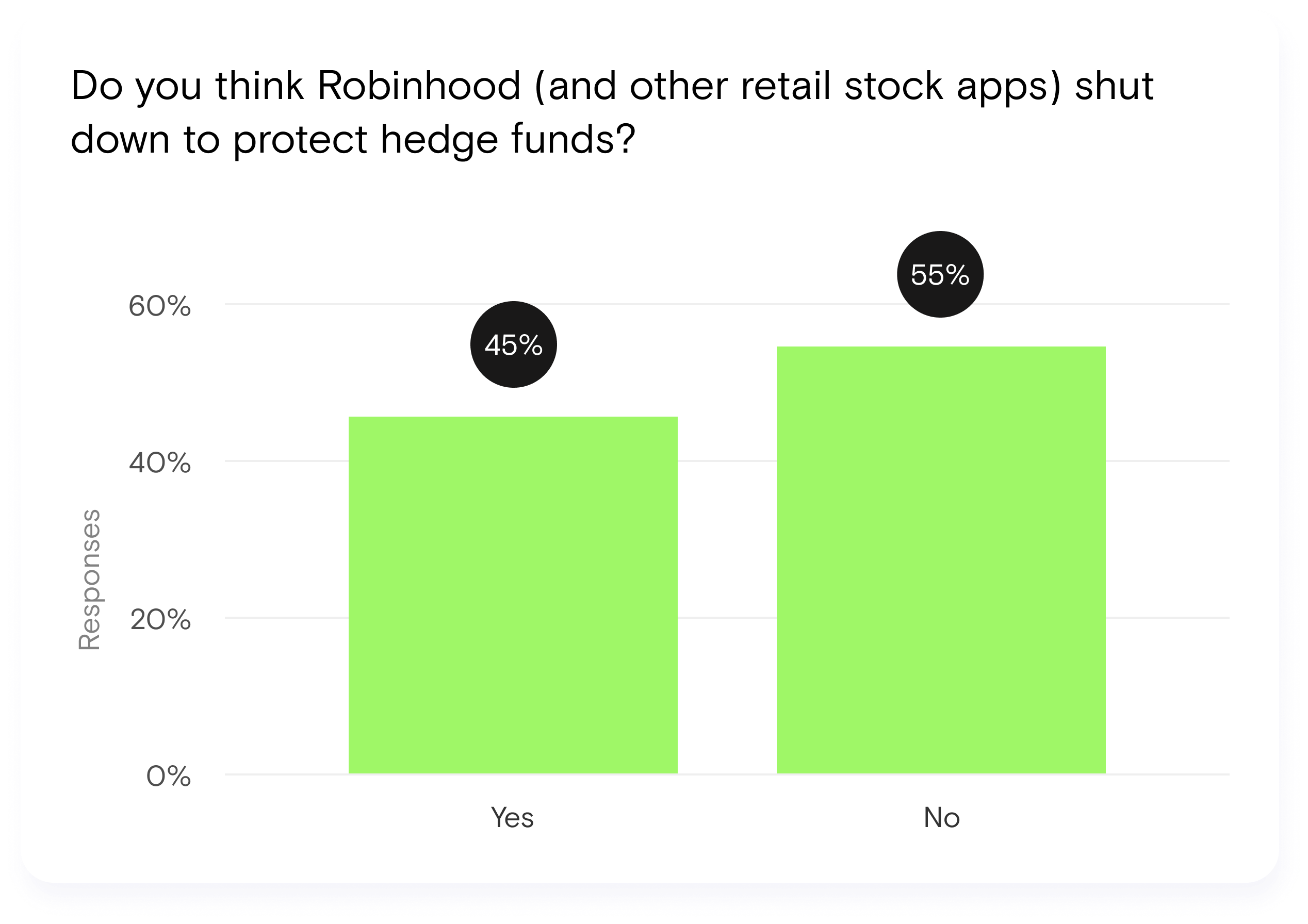

There’s been a lot of talk about Robinhood and GameStop lately. We surveyed more than 1,300 Americans to determine how they felt. Turns out a majority of people found Robinhood guilty of market manipulation by closing down trading of GameStop stocks to protect hedge funds.

Highlights

- We asked 1,300 people what they thought of the stock market events of earlier this month.

- The results were by and large in favor of the home traders vs. the hedge funds.

- However, when you look closer at the data, opinions are mixed about whether it was overall good for the market.

- Ultimately, Robinhood does not look good regardless of how you look at the data.

Results

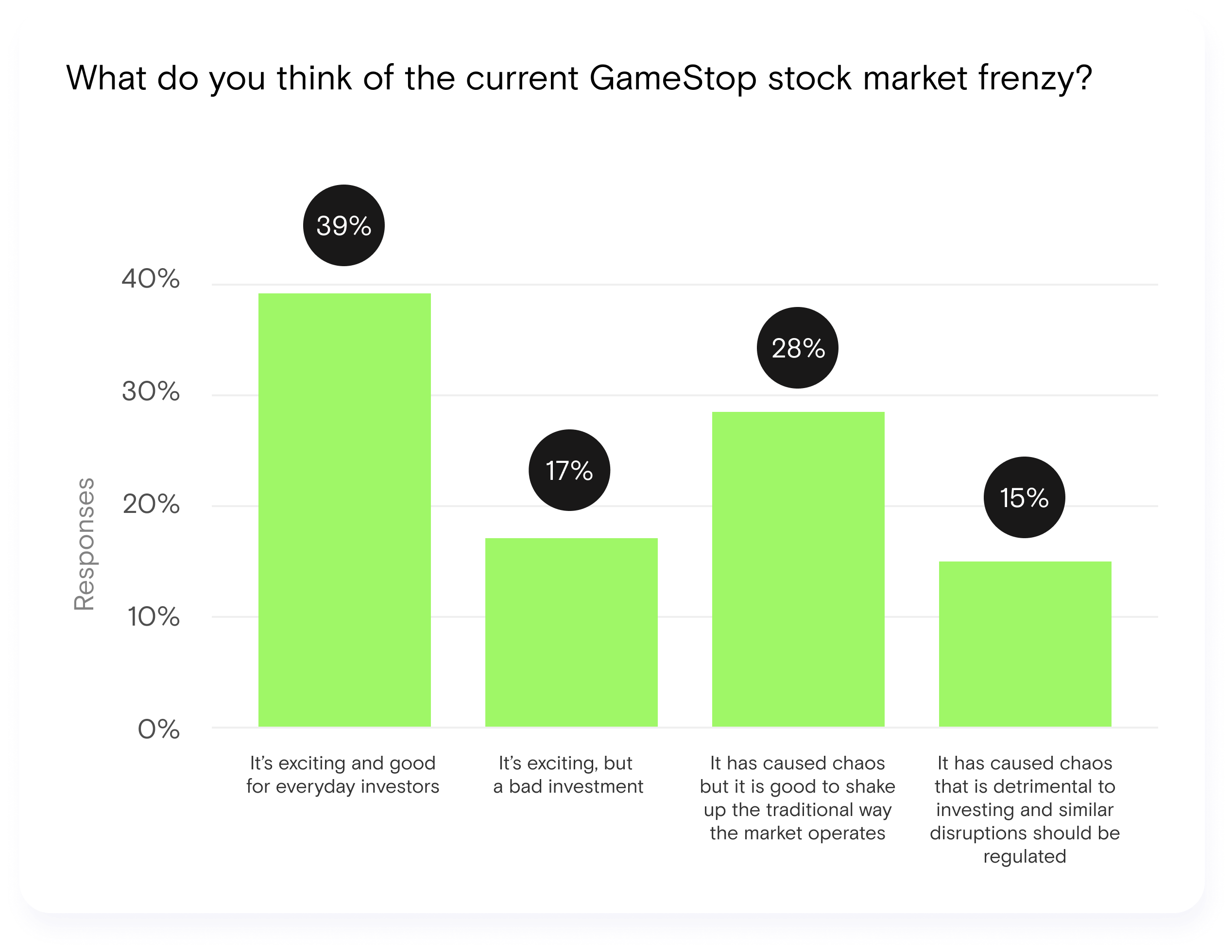

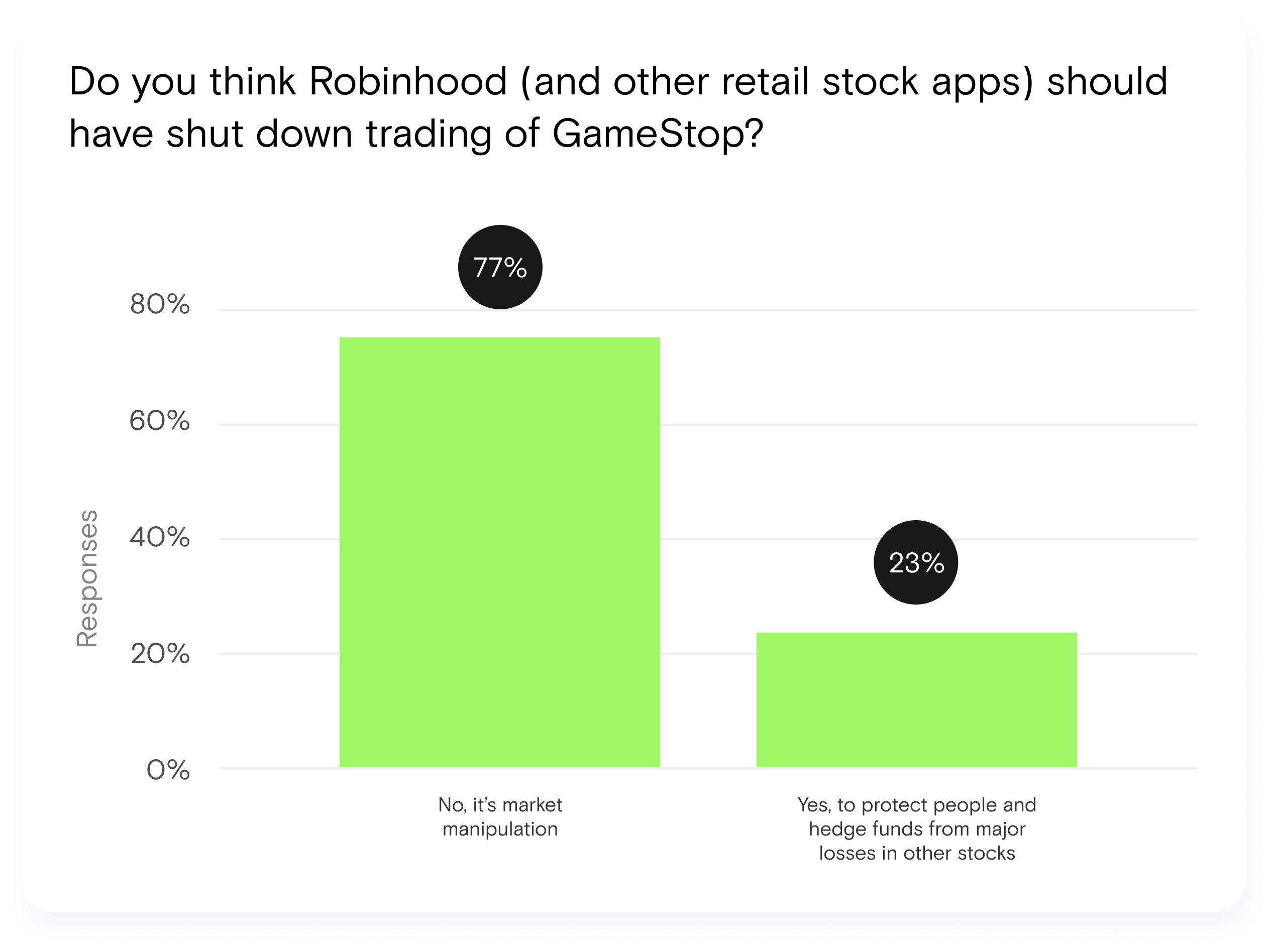

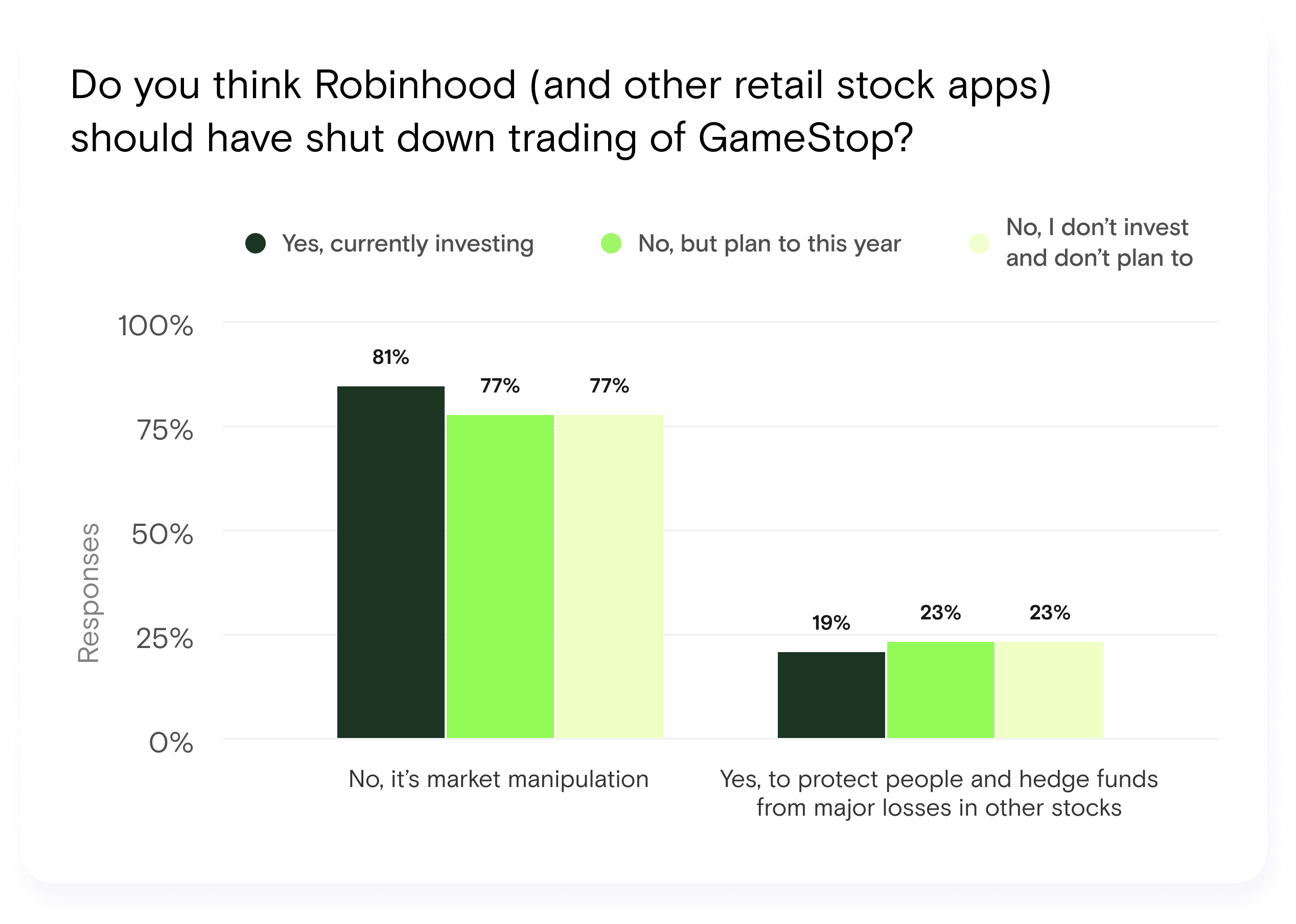

When asked about the current Gamestop market frenzy, people were clearly excited, but had mixed reactions. 39% felt it was exciting and good news for investors, while 17% felt it was exciting but a bad investment. 28% felt it caused chaos but that shaking things up from time to time is a good thing, whereas 15% felt the chaos is detrimental to investing. What was very clear is that 77% feel that Robinhood shutting down trading was market manipulation, with mixed opinions about who they were trying to protect – individual investors or hedge funds.

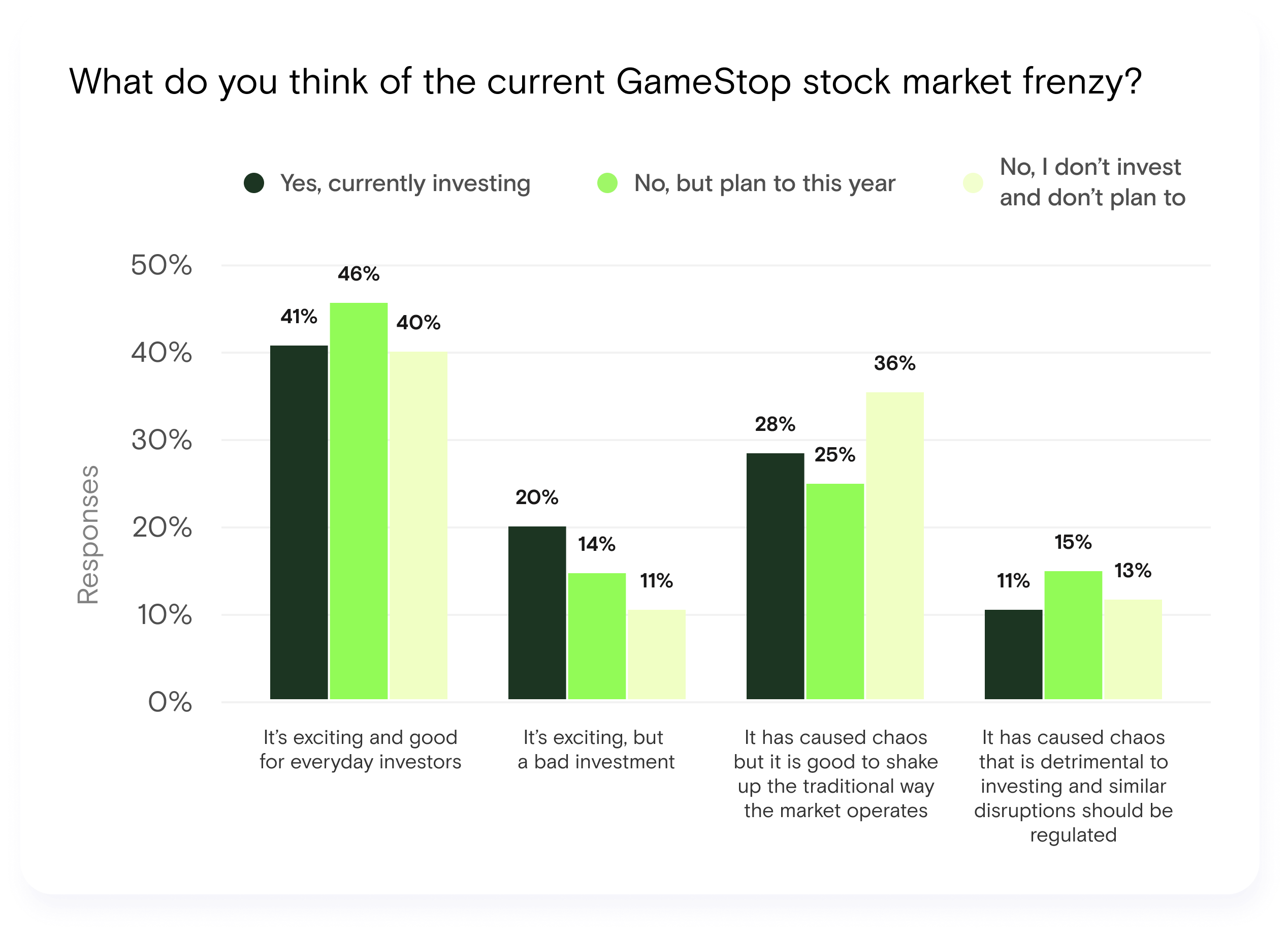

What’s interesting to see is what people think about the situation when compared with whether they are currently investing or not. Surprisingly, this didn’t seem to impact people’s opinions as much as may have been expected. An average of 42% of people in all groups still felt the Gamestop stock market frenzy was exciting and good news for investors.

Regardless of whether they thought this was a positive or negative for the market, few landed in trading platform Robinhood’s camp. Among those who are active in the stock market 81% said that Robinhood suspending trading of GameStop stock and others in order to prevent continuing losses by hedge funds seemed like market manipulation. For those who are not currently active in the market but plan to be this year, that number is 77%. Even those who have no plans to take part in the stock market viewed Robinhood’s actions as market manipulation to the tune of 77%.

The Process

From Feb. 2 to Feb. 5, Invisibly surveyed 1352 people using its Realtime Research tool to gauge public opinion about the wild few days the stock market had near the end of January. We asked their opinion on the events as a whole and specifically about the action of trading platform Robinhood which paused GameStop trades on their platform in order to protect hedge funds from losing more money on their short sales. We also asked about their involvement in the stock market.

We Asked

- What do you think of the current GameStop stock market frenzy?

- Do you think Robinhood (and other retail stock apps) should have shut down trading of GameStop?

- Do you think Robinhood (and other retail stock apps) shut down to protect hedge funds?

- Do you currently, or plan to, invest in the stock market?

Discussion

Robinhood’s brand certainly took a major hit after deciding to halt trading on GameStop and other stocks in order to protect hedge funds from continuing to lose money on their short sales. An overwhelming number of Americans — even those who have no connection to the stock market at all — found that Robinhood was guilty of market manipulation through their actions. It’s hard to believe that there could be a bigger loser in this whole event than the hedge funds who lost tens of millions on the deal, but Robinhood may have done serious long lasting damage to their brand.

Ultimately, most people thought that the wild ride in the stock market toward the end of January was a positive thing. A plurality was totally positive, pointing out that it was a good thing for everyday investors. Some felt it was a good thing but not the best bet in terms of actual results for those traders. And a surprising percentage felt that the chaos that it brought was a welcome shakeup to the status quo, implying that it could lead to a more equitable system. The long term effects of these events still remain to be seen, but the public opinion is very much on the side of the everyday investors as opposed to the hedge funds and their partners.

Invisibly Realtime Research surveys differ from traditional online surveys in that the questions are shown to the user on web pages in place of an ad (Figure 1). Unlike Google Surveys, which block access to content until the questions are answered, Realtime Research surveys are optional, thus ensuring that participants are responding voluntarily.

Invisibly

Use your data to access premium content you love.