State of Banking in 2021

What are Americans’ banking habits amid the pandemic? We surveyed over eight hundred Americans about the way they bank, how often they go to the bank, how often they use an ATM, how they save money, and more. The results show that the majority of Americans still go to physical banks in some capacity, even if rarely, but more people do online banking than those who go to the bank as their primary way of banking.

Highlights

- We used our Realtime Research surveys to ask Americans about their banking preferences and habits.

- Generally, most respondents still go to a physical bank, but more people do online banking as their main form of banking than those who go to a physical bank as their primary way of banking.

- Majority of respondents do not withdraw money from an ATM.

- Respondents who go to the physical bank are more inclined to regularly look at their bank statements.

Introduction

From January 12th to January 14th, we used a Realtime Research survey to canvas Americans about their banking preferences and habits. We measured the way people prefer to bank, how often they go to the bank, how often they draw from the ATM, if they have a savings account, if they have a CD account, if their bank offers free advice, and how often they look at their bank statements. Over the 3-day survey period, we received 4,076 responses from 875 individuals from all over the country.

Invisibly Realtime Research surveys differ from traditional online surveys in that the questions are shown to people on web pages in place of an ad (Figure 1). Unlike Google Surveys, which block access to content until the questions are answered, Realtime Research surveys are optional, thus ensuring that participants are responding voluntarily.

Figure

1. An example of the 300×250 Realtime Research survey unit. Questions are shown to the user on webpages

in place of an ad.

,

Results

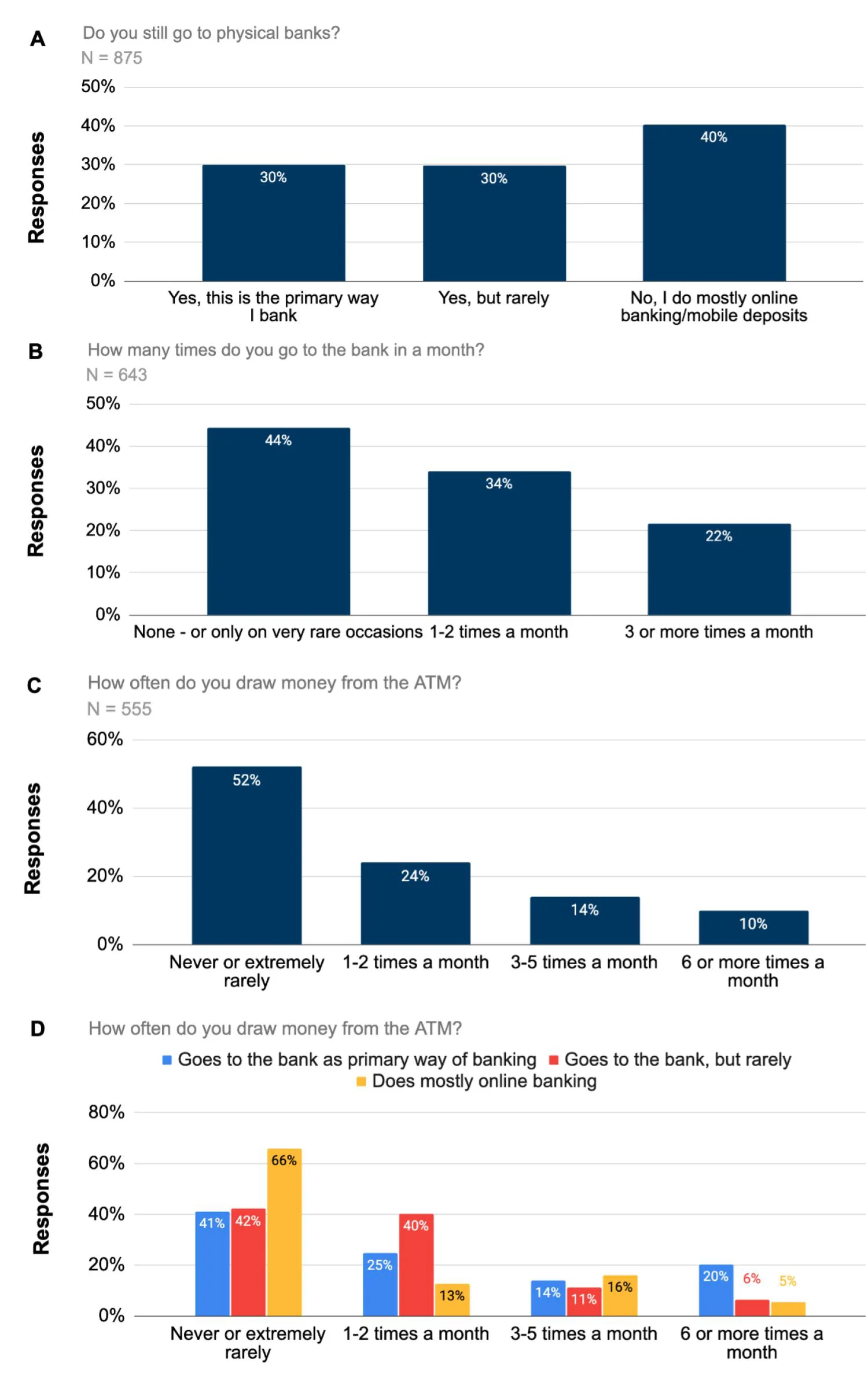

Americans appear to be split in their preferred way of banking. Our results show that

out of all 875 respondents, 30% of users say they still go to physical banks as their primary way of banking,

30% say they do go to banks, but rarely, and 40% said they do mostly online and mobile banking (Figure

2A). Similarly, 56% of respondents claim they go to the bank one or more times a month

(Figure 2B). However, even though the majority of respondents claim to go to the bank at

least once a month, 52% of respondents say they never or extremely rarely draw money out of the ATM

(Figure 2C). When looked at more closely, we found that 66% of respondents who claim to do

mostly online banking over traditional banking never draw cash out at an ATM while the majority of respondents

who still go to physical banks withdraw cash at least once a month (Figure 2D).

Figure 2. Americans banking preferences, bank visit frequency, and ATM habits. A. Results from our Realtime Research surveys suggest that the majority of Americans still go to physical banks in some capacity, but online banking is more popular than going to the physical bank as the primary way of banking B. Majority of respondents still visit a bank at least once a month. C. Majority of respondents never or very rarely draw money from an ATM. D. Majority of people who still go to a physical bank withdraw from an ATM at least once a month.

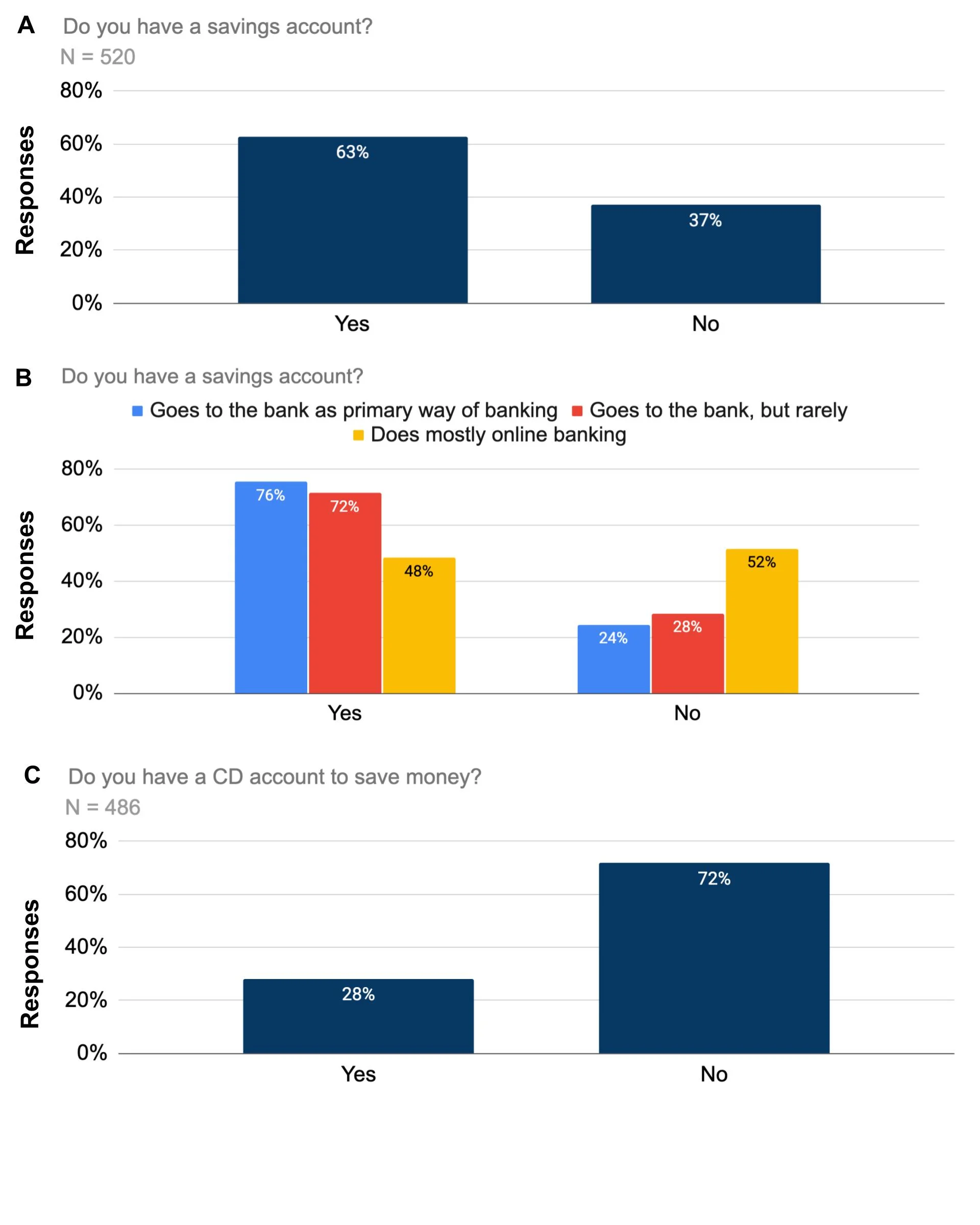

We found that 63% of respondents claim to have a savings account (Figure 3A). When looked at more closely, the vast majority of respondents who still go to a physical bank have savings accounts, but the majority of users who do mostly online banking do claim to not have a savings account (Figure 3B). While the majority of respondents overall claim to have a savings account, only 28% claim to have a CD Account (Figure 3C).

Figure 3. American’s savings accounts A. Results from our Realtime Research surveys suggest that the majority of Americans have a savings account B. The majority of people who do mostly online/mobile banking do not have a savings account. C. The majority of Americans do not have a CD account.

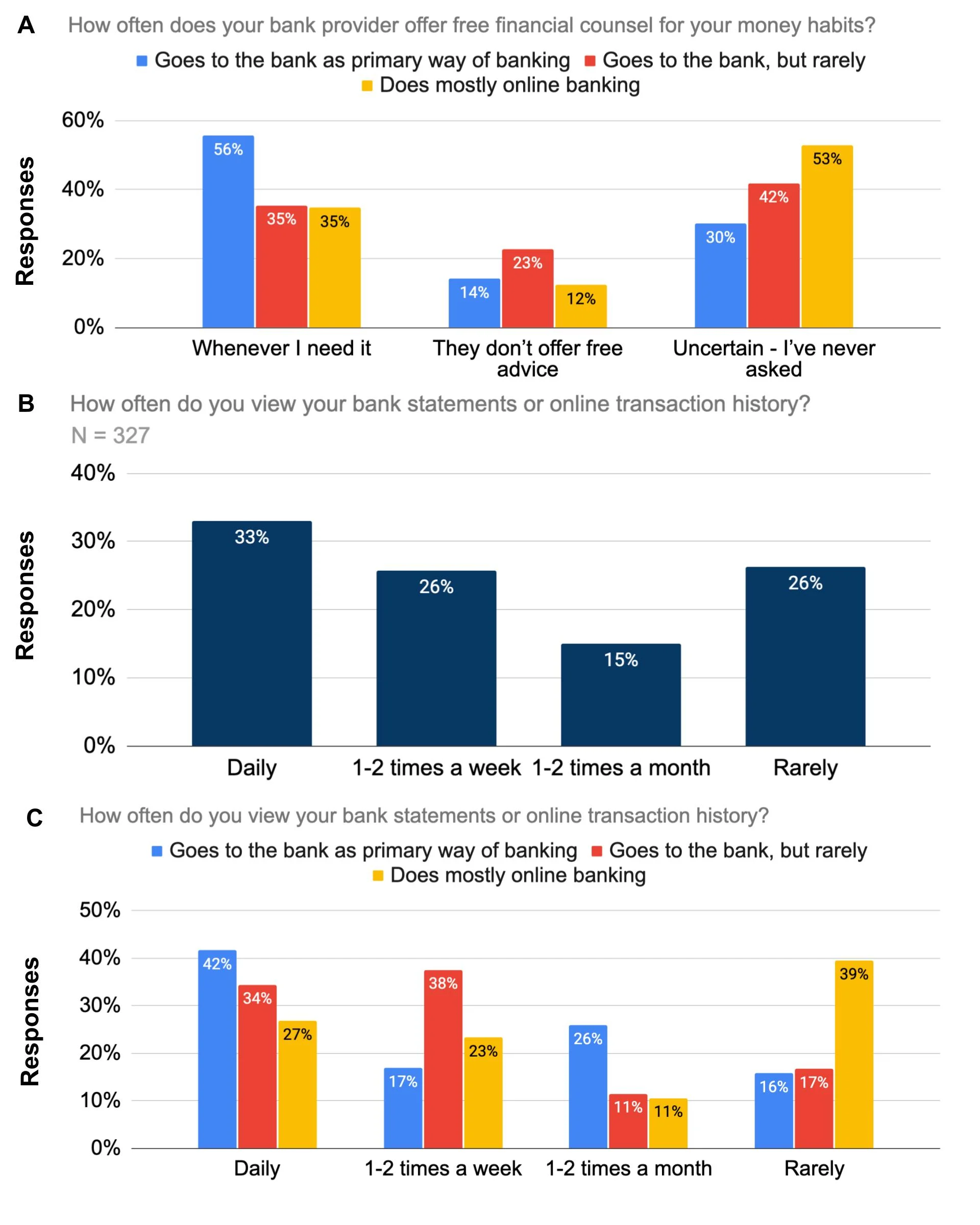

We also found that the majority of people who go to the bank as their primary way of banking said that their bank offers free advice for their money habits (Figure 4A). Those who rarely go to the bank and those who do mostly online banking were less likely to have asked for advice than those who go to the bank as their primary way of banking (Figure 4A). Additionally, we found that the majority of respondents look at their bank statements or online transaction history at least once a week (Figure 4B). More specifically those who still go to a physical bank look at their statements and transaction history more often than those who do mostly online banking (Figure 4C)

Figure 4. How often

respondents’ banks provide free advice and How often respondents look at their bank statements. A. Those

who do mostly online/mobile banking ask for financial advice less often then those who go to physical

banks. B. Majority of Americans look at their bank statements or online transaction history at least once

a week. C. Those who still go to a physical bank look at their statements and transaction history more

often than those who do mostly online banking..

Figure 4. How often

respondents’ banks provide free advice and How often respondents look at their bank statements. A. Those

who do mostly online/mobile banking ask for financial advice less often then those who go to physical

banks. B. Majority of Americans look at their bank statements or online transaction history at least once

a week. C. Those who still go to a physical bank look at their statements and transaction history more

often than those who do mostly online banking..

Discussion

We show here that most Americans still go to a physical bank in some capacity but

there are more people doing mostly online/mobile banking than going to the bank as their primary form of

banking. This could be because of the pandemic but also because digital banking has become a more viable

solution for many in recent years.

It also is not surprising that the majority of respondents never

take cash out of the ATM, which shows the influence of the pandemic on the usage of cash and the growth of

digital payments.

As far as savings accounts go, it is not surprising that the majority of users have

one. However, it is surprising that the majority of respondents who do online banking claim to not have one.

Perhaps the process of traditional banking influences people to open up a savings account whereas digital

banking does not. This might be explained by the fact that the majority of respondents who do more traditional

banking said that their bank offers free advice for their money habits while respondents who do mostly online

banking said they have never asked for advice. Respondents who do traditional banking may be more inclined to

ask their banker questions and explore their options than those who do mostly online banking.

It seems as though those who do traditional banking are more aware of and careful about

their financials which could be explained by the above points about savings accounts and asking bankers for

advice but also by the fact that we showed that those who do more traditional banking look at their bank

statements and online transactions more frequently than those who do mostly online and mobile banking.

Dr. Don Vaughn, Ph.D.

Dr. Don Vaughn is a neuroscientist, futurist, and communicator. As Head of Product at Invisibly, he is envisioning a better future by enabling people to take control of their personal data. He leverages his understanding of the brain to predict how people will use—and be used by—technology. Since graduating from Stanford, over 1 million people have viewed his TEDx talk. He has been featured on ABC, ESPN, Bloomberg and more.